Social media is a powerful tool for insurance agencies to reach potential clients and build relationships with them.

With the right strategy, social media marketing for insurance agents can help to build brand awareness, generate leads, and increase sales.

Agencies can also use social media to target prospective clients based on their interests, location, or demographics. They can create targeted ads that are tailored to a specific audience, increasing the chance of generating leads from those ads.

In this blog post, we’ll discuss how agencies can harness the power of social media to grow their client base and scale their insurance business.

I will also show you a fame-building strategy for insurance agents who would like to create a strong online presence and reach more potential clients.

Can insurance agents use social media?

Definitely!! Social media networks are incredibly powerful tools that allow you to find and target customers.

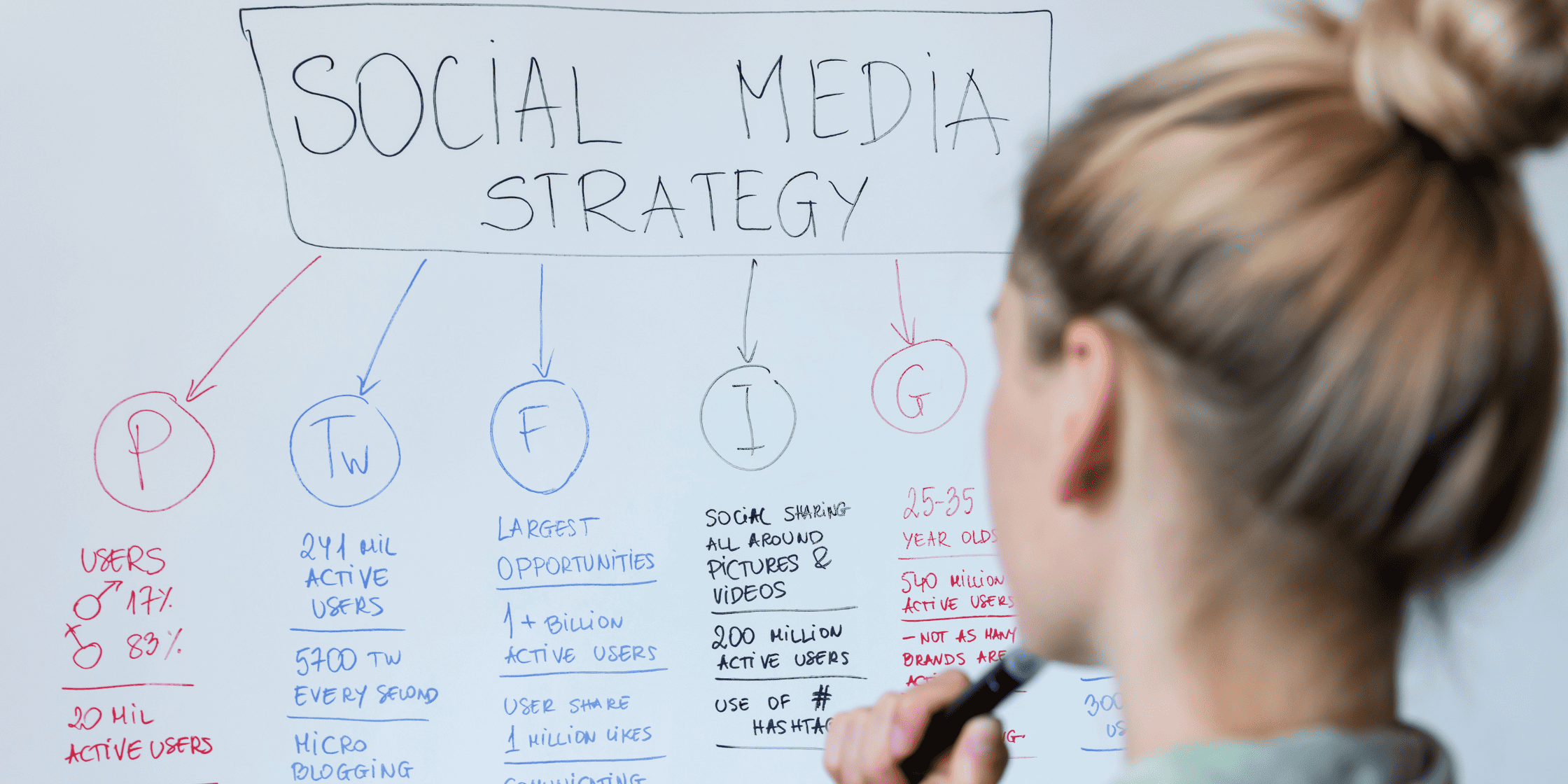

Facebook, Twitter, LinkedIn, Instagram – these are all great places for your agency to post updates about what you do and why people should choose your services over others. You can also create targeted campaigns on these platforms that will help you reach potential clients.

Social media marketing for insurance agents can be used to stay in touch with current clients, answer questions, and provide customer service. It’s a great way to build relationships over time and create brand loyalty.

One way to leverage social media presence it to post helpful content related to the insurance industry such as tips for saving money when buying insurance or news about new policies. This type of content can help establish the insurance agent as an authoritative source in their field and increase brand visibility.

Social media is also a great place for insurance agencies to interact and engage with potential customers by responding to comments, answering questions, and providing helpful resources. This helps build trust and establish relationships that can lead to increased sales.

Finally, insurance agents can use social media platforms like Instagram or Pinterest to showcase success stories of clients who have purchased their policies. This will help create positive word-of-mouth and attract more leads to the agency.

With a strategic plan and consistent execution, insurance agents can effectively reach potential customers, build relationships with them, and achieve success in a competitive market.

Keep reading and I will show you a fame-building strategy for insurance agents to help build a solid reputation in your area.

How to promote insurance products on social media?

Promoting insurance products on social media is no easy task, but with the right strategy, it can be done.

If you want to market your insurance agency on social media – without throwing money at the wall for little to no results…

Follow these 5 Key Pillars if you want to build your reputation and sell more policies.

The 5 Pillars of Great Social Media Marketing for Insurance Agents (Ignore these at your own risk…)

1. Understand the Basics

Before you can start marketing on social media for your insurance agency, you need to understand the basics of social media marketing.

Learn about the different platforms, how to create and post content, and how to measure the success of your campaigns.

2. Research Your Audience

Before you can create effective social media campaigns, you need to know who your target audience is and what they want to see.

Research your audience by looking at the demographics of your current clients and researching the social media habits of people in your target market.

3. Create a Strategy

Once you’ve done your research, it’s time to create a social media strategy. Decide which platforms you want to focus on, set goals for your campaigns, and generate content ideas for your content calendar.

4. Monitor and Analyze

Once you’ve launched your campaigns, it’s important to monitor and analyze their performance. Look at engagement metrics such as likes, comments, and shares to see what’s working and what’s not.

5. Test and Adjust

As you monitor and analyze your campaigns, be sure to test different strategies and adjust your approach as needed. This will help you refine your campaigns and maximize their effectiveness.

These are the 5 Pillars I abide by in my own agency…

And it’s what all of my most successful students have embraced too.

So I hope you found this useful, and that you’ll take these into real consideration.

How to introduce yourself as insurance agent in social media platforms?

Here is the $5/day fame building strategy for insurance agents to build a reputation in your area.

This $5/day strategy crushes direct mail and will make you “famous” in your local area.

Create content focusing on the following:

- A video content introducing your agency and staff. Explain what you do. Let your audience know what is unique about you and your insurance agency.

- Follow it up with 2-3 more videos educating people on insurance, the different products based on their insurance needs and how to save money.

Run the first video content in the neighborhoods you want to target.

Then.. retarget the people that watched that video with the education vids. (That one is KEY)

If you want to scale you can expand the area you want to cover and also increase the ad budget.

I did this for almost a year. The results:

1. I started getting leads

2. Neighbors kept telling me that they always see my “commercials” on social platforms

3. Loan Officers and Realtors started recognizing me and was an easier introduction

It is simple but most won’t do it.

Meaning if you do it.. you’ll have an edge over the competition.

So hopefully you’ll take this and implement it.

2023 Insurance Outlook: Referrals in a crumbling market?

With the current state of the housing market, alotta insurance “experts” are regurgitating the same old one-liners like…

“The housing market’s dead.”

“Referrals are dead.”

“Time to just focus on auto.”

And on the list goes…

Stuff like this certainly doesn’t help either…

But listen, if we look at the stats…

Plenty of homes are still getting sold.

Check this from statista:

Predicting a solid 6.07 million existing homes getting sold this year.

…which is almost 2 million MORE than what was sold during the 2007/8/9 crash.

I could go on all day with stats and graphs, but…

What you really care about is:

“What’s this mean for my insurance agency?”

What it means is…

That now is the time to go ALL-IN on building solid referral relationships.

Planning on social media posts to connect with potential referral partners and clients.

Leveraging the power of content marketing to build your reputation and authority in the insurance industry.

And the reason why, is that we’ve got a rare opportunity where top referral partners are up for grabs.

Because before, when business was booming…

They wouldn’t have given you the time and day.

And they didn’t need “help” from yet another insurance agent.

But now things have changed.

Case in point…

Students of mine like Ryan, Jimmy and Quan are ‘cranking up’ the number of LOs and Realtors they’re getting in touch with.

Now, is the quantity of referrals you can expect to get back gonna be reduced?

Sure.

But you also have to think about the long run here…

Because building massive loyalty with referral partners now is a great way to set yourself up to thrive when the next boom cycle hits.

(Just look at the last century of US economy trends and you’ll see it’s inevitable)

So the bottom line is…

Don’t let all the fear mongering snap you out of doing what’s right for your agency.

Like building sound relationships…

The opportunity here is HUGE if you’re willing to treat it like one…

And I suspect there’s gonna be alotta insurance agency owners who, in 2 or 3 years from now…

Are gonna be left on the outside looking in.

Wishing they leveraged social media marketing for insurance agents when they had the chance…

While the smart agents and their referral partners enjoy the next boom cycle together.

Something to think about if you’re not already…

Nato owns Guajardo Insurance Agency. He learned the lessons he needed to learn so that his agency avoided the traditional ups and downs of lead flow and sales. He created Fully Covered to do just that. A methodology and system that provides predictable and automated online leads to insurance agents that have a passion for helping people.

Today, Nato runs his business together with his wife, Angelica, without the stress of finding the next client or worrying about if there is enough money in the bank. Plus, he gets to protect clients with our Agency and protect his peers through education and systems that took years to figure out on his own.